AI Will Reshape 40% of Banking Work by 2030, Says ThoughtLinks CEO Sumeet Chabria

By 2030, nearly 40% of banking operations, technology, and knowledge work will be transformed by AI, according to a ThoughtLinks analysis led by CEO Sumeet Chabria.

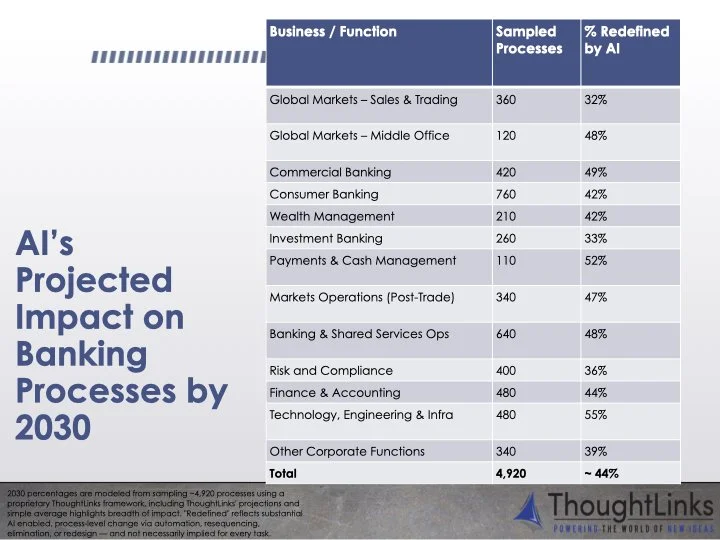

ThoughtLinks—a strategic advisory firm founded by global banking executive Sumeet Chabria—projects that by 2030 approximately 40% of banking technology, operations, and knowledge work will be fundamentally redefined by AI, based on proprietary analysis of nearly 5,000 banking processes.

The Shift is Already Happening

This transformation isn't merely coming—it’s actively underway. Our research identifies several converging forces driving significant structural evolution in banking:

Generative and Agentic AI: Automating and predicting tasks intelligently.

Democratized Access to Data: Empowering data-driven decisions across organizations.

Cloud-Native Infrastructure: Providing scalability, flexibility, and accelerated innovation.

Intelligent Automation: Streamlining routine processes and freeing capacity for strategic human intervention.

ThoughtLinks: AI’s Projected Impact on Banking Processes by 2030

Human-Centric AI: Amplifying Potential in Banks and Capital Markets

Our research highlights that the most impactful AI use cases in banking amplify human potential. They enable professionals to dedicate attention to strategic, high-value tasks by delegating routine activities to digital workers—intelligent AI agents designed for seamless collaboration. To effectively realize AI’s potential, banks should adopt an AI-first strategy clearly articulated at the enterprise level (top-down), while systematically evaluating and prioritizing specific processes (bottom-up) where work activities are codified.

Four Strategic Pillars for Successful AI Adoption in Banking

ThoughtLinks identifies alignment of four strategic pillars essential for banks to enable AI driven business strategies.

AI-First Technology Strategy: Prioritizing strategic AI investments aligned with core business goals.

Enterprise-Wide Transformation: Ensuring organizational alignment to fully capture AI’s benefits.

Growth and Efficiency Through AI: Establishing clear measurable outcomes to enhance operational performance, client experience, and competitive positioning.

Future-Ready Workforce Strategies: Preparing teams with skills and roles required in an AI-enabled workplace.

Industry-Specific AI Use Cases

In Sumeet Chabria's exclusive interview with Business Insider , we categorized practical examples of AI transformations into three insightful groups:

Already Happening: Immediate applications such as automated documentation in investment banking and AI-driven personalization in wealth management.

Expected by 2030: Near-future transformations including sophisticated risk modeling and advanced client engagement tools in commercial banking.

Resistant to Change: Processes deeply rooted in regulatory complexity or requiring uniquely human judgment.

Explore Further Insights

For deeper context, review the full original sources:

ThoughtLinks Press Release: AI to Reshape 40% of Banking Work by 2030

Business Insider: Almost half of the work banks do could be ‘redefined’ by 2030 (subscription required)

Share Your Perspective

We invite banking leaders and professionals to reflect on their experiences:

How is AI reshaping your institution’s strategic vision?

In what ways is your role evolving in response to AI?

Stay connected with ThoughtLinks on LinkedIn for continued insights into banking innovation and AI-driven transformation.